In this short article, we’ll think about why you need to begin realty investing now instead of later on and after that follow it up with a couple of recommendations to assist you to begin.

The proverbial stating “time is cash” holds true in property investing. Due to a phenomenon referred to as compounding, cash grows much faster and quicker as time passes. The quicker you put your cash to work in a genuine estate financial investment, over time the more cash you will collect.

In the very same method, the longer you wait to begin property investing, the less time you need to integrate the elements of time and intensifying interest, and for this reason (presuming all things equivalent) the less wealth you can anticipate to collect as an outcome. Find out the best Atlanta GA realtor to have the best investment.

State your objective is to retire at age sixty-five. Since of intensifying, you stand a far much better opportunity of attaining more wealth by retirement if you begin investing at age twenty-five rather then at thirty-five, or forty-five, and so on.

How to Begin Realty Investing

- Establish a strategy – Just how much can you invest easily? Are you anticipating capital or simply wanting to make your cash when the home is resold? For how long do you prepare to own the home? What quantity of your own effort can you manage to contribute? What quantity of wealth do you prepare to collect, and by when?

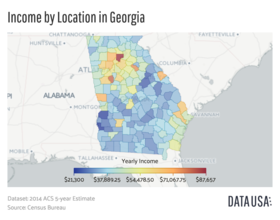

- Familiarize yourself with the regional rental market – Check out the regional papers and see what kinds of earnings residential or commercial property have the greatest need for renters. If there are lots of classifieds looking for apartment or condo occupants, maybe the retail area is more in need and vice versa. Simply put, discover what item would be best for you to purchase.

- Familiarize yourself with the rates of return – At the minimum comprehends the distinction between money and money return, return on equity, and cap rate. Whereas money on money may reveal what your money financial investment may accomplish in one year, and return on equity over future years, cap rate assists you to pick a residential or commercial property at a reasonable market price.

- Buy realty financial investment software application – It is never ever a great concept to depend on somebody else’s numbers. It’s your cash. Constantly run your own numbers on possible financial investment chances. Having the capability to develop your own rental residential or commercial property analysis offers you more control about how the capital numbers exist and a much better understanding of a home’s success.

- Develop a relationship with a realty specialist that understands the regional realty market and comprehends rental home. A competent realty expert familiarized with your market can be a genuine plus. It will not advance your financial investment goals to hang out with the representative of the year unless that individual learns about financial investment home and is sufficiently prepared to assist you properly acquire it.

- Prevent purchasing into realty investing “trade tricks”. Lots of property investing experts out there repackage and offer the precise very same product as the next expert. The sizzle in the business of realty investing, nevertheless, has to do with owning a piece of ground that, if unduly looked into and bought smartly by objective numbers, with cautious management, will likely be better tomorrow than it is today.